The smart Trick of Real Estate Reno Nv That Nobody is Discussing

Our Real Estate Reno Nv Diaries

Table of ContentsFascination About Real Estate Reno NvThe Single Strategy To Use For Real Estate Reno NvThe 6-Second Trick For Real Estate Reno Nv10 Simple Techniques For Real Estate Reno Nv

That may appear pricey in a world where ETFs and mutual funds may bill as little as no percent for creating a varied profile of supplies or bonds. While systems might vet their investments, you'll have to do the same, and that suggests you'll require the abilities to examine the chance.Caret Down Resources appreciation, reward or passion repayments. Like all investments, genuine estate has its benefits and drawbacks. Below are a few of the most important to bear in mind as you weigh whether or not to buy genuine estate. Long-lasting gratitude while you reside in the property Possible bush against rising cost of living Leveraged returns on your investment Easy revenue from leas or with REITs Tax benefits, consisting of interest deductions, tax-free funding gains and depreciation write-offs Fixed lasting financing offered Gratitude is not assured, particularly in economically clinically depressed areas Home prices might fall with greater rate of interest A leveraged financial investment suggests your deposit goes to danger Might require significant time and cash to manage your very own residential properties Owe a set home loan payment every month, also if your tenant doesn't pay you Reduced liquidity for real property, and high compensations While real estate does provide several advantages, particularly tax obligation advantages, it doesn't come without substantial downsides, in certain, high commissions to exit the marketplace.

Do you have the sources to pay a home mortgage if an occupant can not? Just how much do you depend upon your day work to maintain the financial investment going? Readiness Do you have the need to act as a property manager? Are you happy to deal with occupants and comprehend the rental legislations in your area? Or would certainly you prefer to evaluate offers or financial investments such as REITs or those on an online system? Do you wish to satisfy the demands of running a house-flipping company? Knowledge and abilities While lots of financiers can learn on the work, do you have special abilities that make you better-suited to one sort of financial investment than an additional? Can you evaluate supplies and build an appealing profile? Can you repair your rental building or repair a fin and conserve a package on paying professionals? The tax obligation advantages on real estate differ extensively, depending upon exactly how you invest, but purchasing genuine estate can supply some large tax obligation advantages. Real Estate Reno NV.

7 Simple Techniques For Real Estate Reno Nv

REITs provide an eye-catching tax profile you won't incur any kind of capital acquires taxes up until you offer shares, and you can hold shares literally for decades to avoid the tax guy. In truth, you can pass the shares on your successors and they will not owe any kind of taxes on your gains.

Property can be an attractive investment, however financiers intend to be certain to match their type site web of investment with their determination and capability to manage it, consisting of time dedications. If you're wanting to generate income during retirement, real estate investing can be one way to do that.

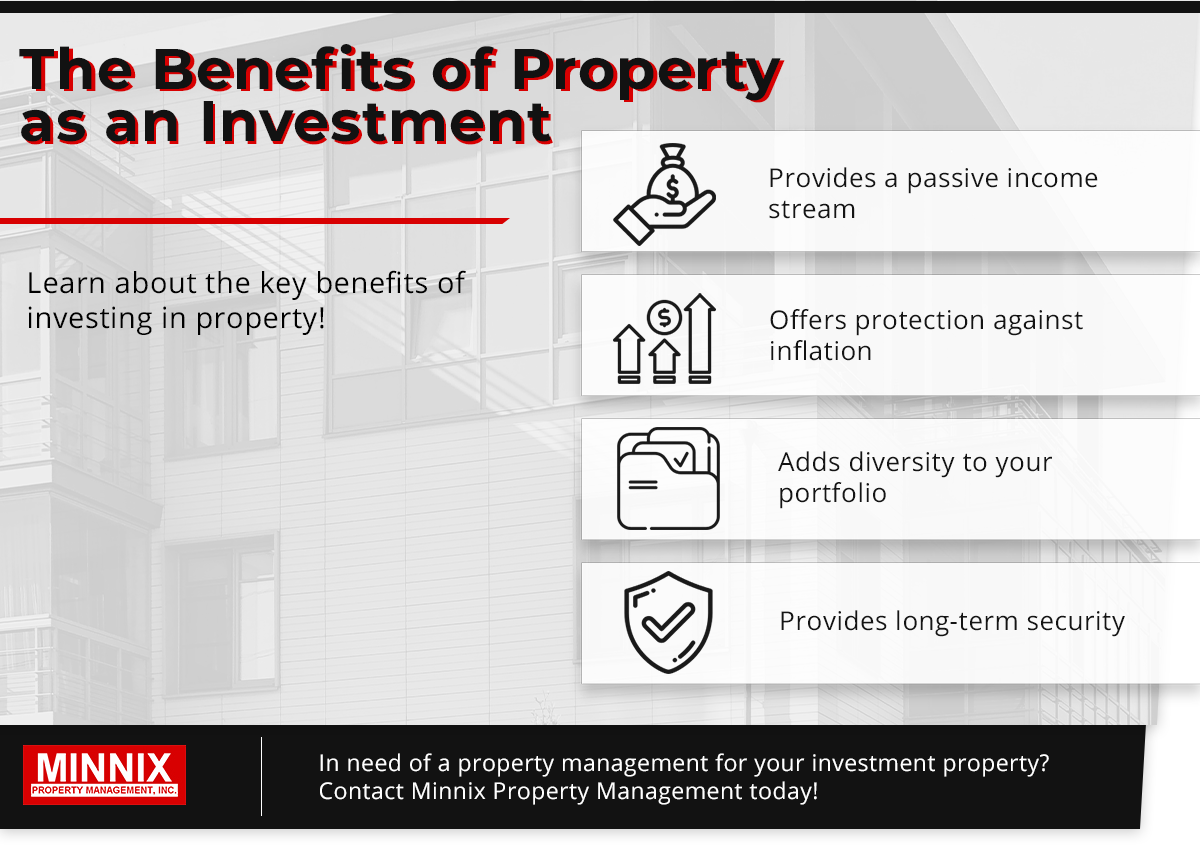

There are several benefits to buying actual estate. Regular earnings flow, strong yields, tax obligation advantages, diversity with appropriate possessions, and the ability to leverage wealth via actual estate are all benefits that capitalists may take pleasure in. Here, we delve right into the various advantages of spending in actual estate in India.

Fascination About Real Estate Reno Nv

Realty tends to appreciate in value in time, so if you make a clever investment, you can make money when it comes time to offer. With time, leas also often tend to enhance, which could enhance cash money flow. Rental fees enhance when economic climates increase since there is even more demand genuine estate, which elevates funding worths.

If you are still working, you might increase your rental income by investing it following your monetary purposes. There are various tax benefits to genuine estate investing.

It will drastically minimize taxed income while lowering the price of actual estate investing. Tax obligation reductions are offered for a variety of costs, such as firm costs, money flow from various other properties, and home mortgage rate of interest.

Realty's link to the various other major possession groups is fragile, sometimes also adverse. Property may as a result minimize volatility and boost return on threat when it is consisted of in a portfolio of different assets. Contrasted to various other possessions like the stock exchange, gold, cryptocurrencies, and financial institutions, buying property can be significantly more secure.

Some Known Details About Real Estate Reno Nv

The stock exchange is continually altering. The real estate market has actually expanded over the past a number of years as an outcome of the application of RERA, lowered home mortgage interest prices, and other aspects. Real Estate Reno NV. The rate of interest on financial institution interest-bearing accounts, on the other hand, are low, specifically when compared to the increasing inflation